Click here to go see the bonus panel!

Hovertext:

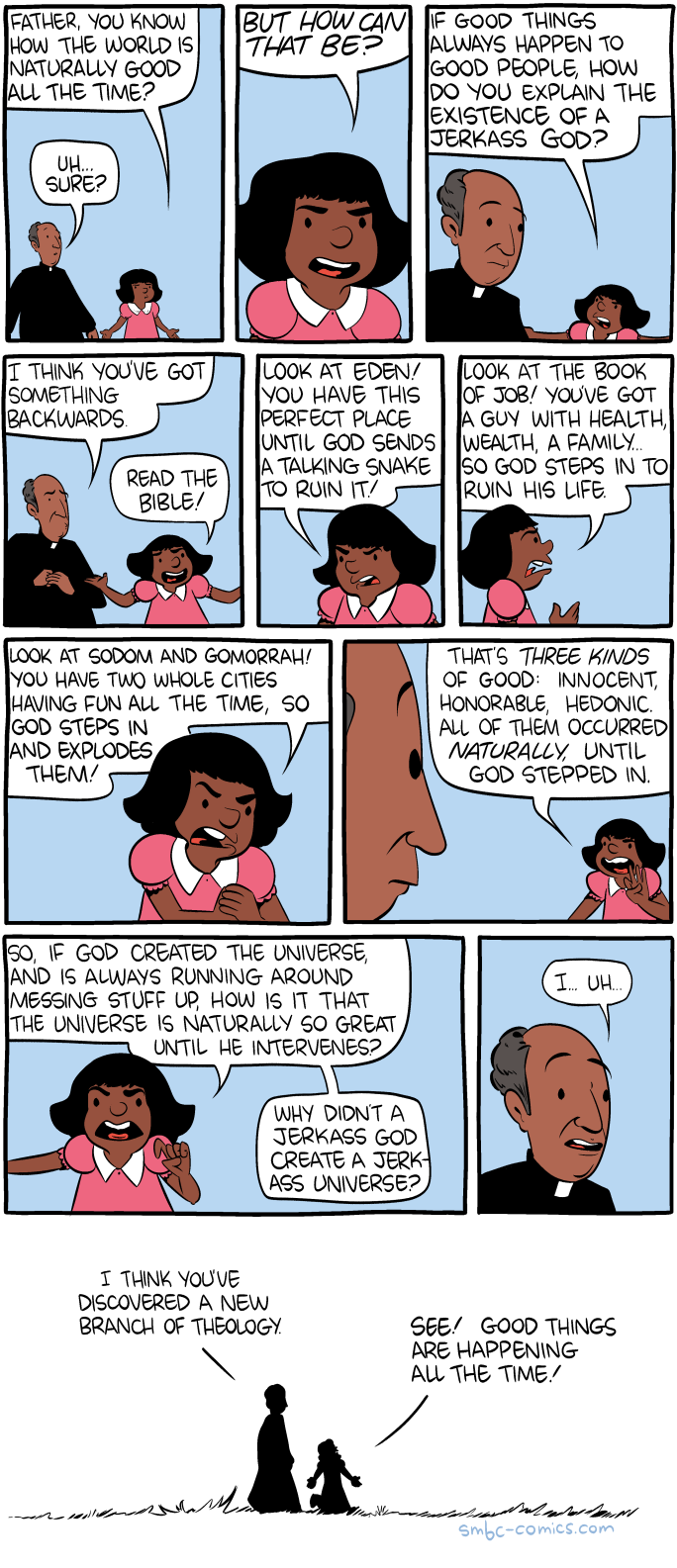

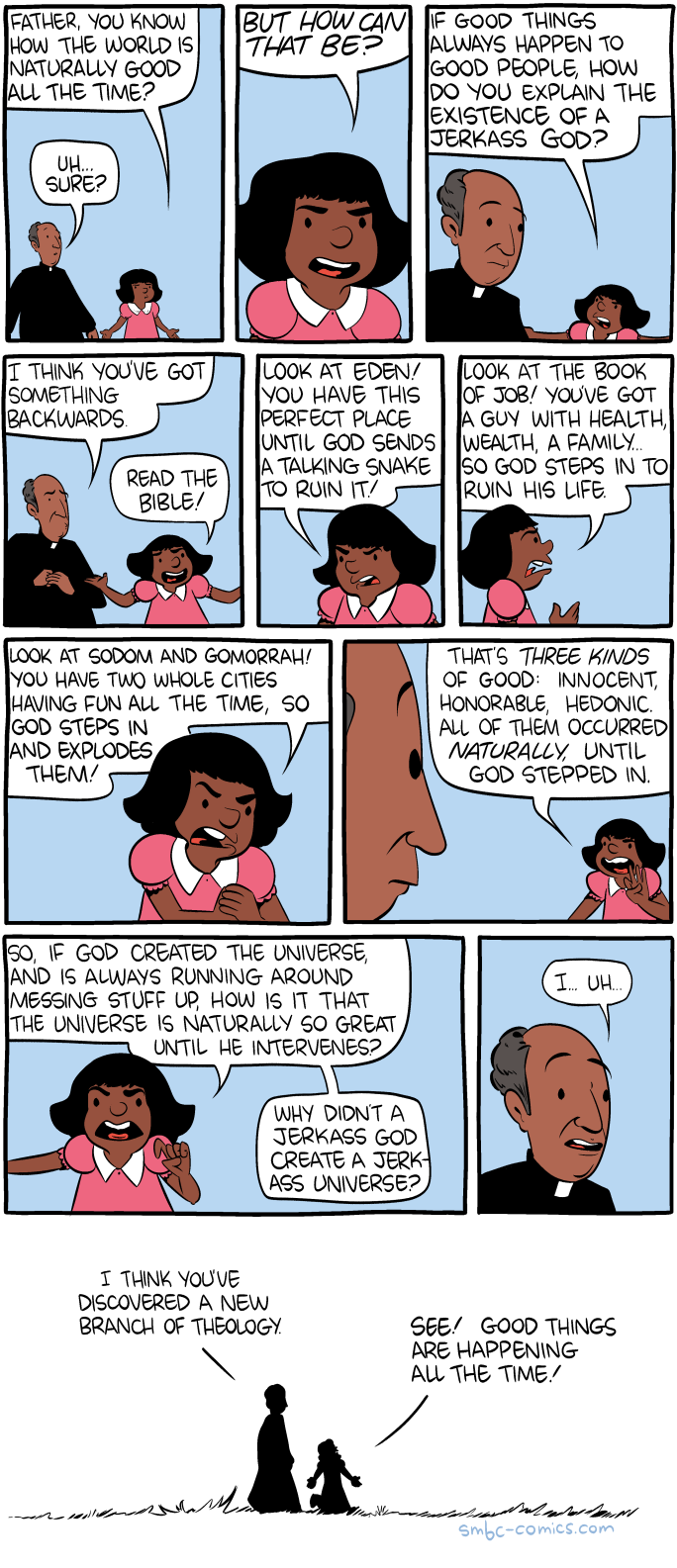

I think you could do an entirely novel exegesis of the Old Testament based around this premise.

New comic!

Today's News:

Hey! Geeks of London! Come see me, March 25th, at Imperial.

Hey! Geeks of London! Come see me, March 25th, at Imperial.

Saint Nicholas was a real, historical person.

But he didn’t live in some snowy Northern place like the North Pole or Scandinavia. And he probably wasn’t fair-skinned with ruddy cheeks.

He lived in the town of Myra – on the Southern Coast of Turkey – in the fourth century (it was then part of Greece). So he likely had an olive-colored, Mediterranean complexion:

Russian icon depicting St Nicholas with scenes from his life. Late 1400s or early 1500s. National Museum, Stockholm

And he didn’t ride a magic sleigh driven by flying reindeer, have a workshop full of elves, squeeze through chimneys with belly-defying dimensions, or maintain a naughty-or-nice list rivaling the NSA.

The real St. Nick came from a wealthy family, and his parents died in an epidemic when he was young. Nick used his large inheritance to help the poor.

For example, poor young girls were likely to be sold into slavery because they didn’t have a dowry with which to attract a husband. So on 3 occasions, Nicholas threw a bag of gold into a poor girl’s house through an open window … enough to provide a dowry so the girl could get married.

The bags of gold are said to have landed in stockings or shoes left in front of the fire to dry. This led to the custom of kids hanging stockings or putting out shoes, hoping for gifts from Saint Nick.

Wikipedia notes:

He had a reputation for secret gift-giving … and thus became the model for Santa Claus, whose modern name comes from the Dutch Sinterklaas, itself from a series of elisions and corruptions of the transliteration of “Saint Nikolaos”.

My wife and I visited Nick’s church in Myra (now called Demre) on the beautiful Antalya coast of Turkey, where he served as Bishop for many years.

In addition to the bags of gold mentioned above, Wikipedia notes another basis for the Christmas stocking tradition: St. Nick put coins in the shoes of those who left them out for him.

Submitted by Michael Snyder via The Economic Collapse blog,

Are much lower oil prices good news for the U.S. economy? Only if you like collapsing capital expenditures, rising unemployment and a potential financial implosion on Wall Street. Yes, lower gasoline prices are good news for the middle class. I certainly would rather pay two dollars for a gallon of gas than four dollars. But in order to have money to fill up your vehicle you have got to have an income first. And since the last recession, the energy sector has been the number one creator of good jobs in the U.S. economy by far. Barack Obama loves to stand up and take credit for the fact that the employment picture in this country has been improving slightly, but without the energy industry boom, unemployment would be through the roof. And now that the “energy boom” is rapidly becoming an “energy bust”, what will happen to the struggling U.S. economy as we head into 2015?

At the start of this article I mentioned that much lower oil prices would result in “collapsing capital expenditures”.

If you do not know what a “capital expenditure” is, the following is a definition that comes from Investopedia…

“Funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. This type of outlay is made by companies to maintain or increase the scope of their operations. These expenditures can include everything from repairing a roof to building a brand new factory.”

Needless to say, this kind of spending is very good for an economy. It builds infrastructure, it creates jobs and it is an investment in the future.

In recent years, energy companies have been pouring massive amounts of money into capital expenditures. In fact, the energy sector currently accounts for about a third of all capital expenditures in the United States according to Deutsche Bank…

US private investment spending is usually ~15% of US GDP or $2.8trn now. This investment consists of $1.6trn spent annually on equipment and software, $700bn on non-residential construction and a bit over $500bn on residential. Equipment and software is 35% technology and communications, 25-30% is industrial equipment for energy, utilities and agriculture, 15% is transportation equipment, with remaining 20-25% related to other industries or intangibles. Non-residential construction is 20% oil and gas producing structures and 30% is energy related in total. We estimate global investment spending is 20% of S&P EPS or 12% from US. The Energy sector is responsible for a third of S&P 500 capex.

These companies make these investments because they believe that there are big profits to be made.

Unfortunately, when the price of oil crashes those investments become unprofitable and capital expenditures start getting slashed almost immediately.

For example, the budget for 2015 at ConocoPhillips has already been reduced by 20 percent…

ConocoPhillips is one of the bigger shale players. And its decision to slash its budget for next year by 20% is raising eyebrows. The company said the new target reflects lower spending on major projects as well as “unconventional plays.” Despite the expectation that others will follow, it doesn’t mean U.S. shale oil production is dead. Just don’t expect a surge in spending like in recent years.

And Reuters is reporting that the number of new well permits for the industry as a whole plunged by an astounding 40 percent during the month of November…

Plunging oil prices sparked a drop of almost 40 percent in new well permits issued across the United States in November, in a sudden pause in the growth of the U.S. shale oil and gas boom that started around 2007.

Data provided exclusively to Reuters on Tuesday by industry data firm Drilling Info Inc showed 4,520 new well permits were approved last month, down from 7,227 in October.

If the price of oil stays this low or continues dropping, this is just the beginning.

Meanwhile, the flow of good jobs that this industry has been producing is also likely to start drying up.

According to the Perryman Group, the energy sector currently supports 9.3 million permanent jobs in this country…

According to a new study, investments in oil and gas exploration and production generate substantial economic gains, as well as other benefits such as increased energy independence. The Perryman Group estimates that the industry as a whole generates an economic stimulus of almost $1.2 trillion in gross product each year, as well as more than 9.3 million permanent jobs across the nation.

The ripple effects are everywhere. If you think about the role of oil in your life, it is not only the primary source of many of our fuels, but is also critical to our lubricants, chemicals, synthetic fibers, pharmaceuticals, plastics, and many other items we come into contact with every day. The industry supports almost 1.3 million jobs in manufacturing alone and is responsible for almost $1.2 trillion in annual gross domestic product. If you think about the law, accounting, and engineering firms that serve the industry, the pipe, drilling equipment, and other manufactured goods that it requires, and the large payrolls and their effects on consumer spending, you will begin to get a picture of the enormity of the industry.

And these are good paying jobs. They aren’t eight dollar part-time jobs down at your local big box retailer. These are jobs that comfortably support middle class families. These are precisely the kinds of jobs that we cannot afford to lose.

In recent years, there has been a noticeable economic difference between areas of the country where energy is being produced and where energy is not being produced.

Since December 2007, a total of 1.36 million jobs have been gained in shale oil states.

Meanwhile, a total of 424,000 jobs have been lost in non-shale oil states.

So what happens now that the shale oil boom is turning into a bust?

That is a very good question.

Even more ominous is what an oil price collapse could mean for our financial system.

The last time the price of oil declined by more than 40 dollars in less than six months, there was a financial meltdown on Wall Street and we experienced the deepest recession that we have seen since the days of the Great Depression.

And now many fear that this collapse in the price of oil could trigger another financial panic.

According to Citigroup, the energy sector now accounts for 17 percent of the high yield bond market.

J.P. Morgan says that it is actually 18 percent.

In any event, the reality of the matter is that the health of these “junk bonds” is absolutely critical to our financial system. And according to Deutsche Bank, if these bonds start defaulting it could “trigger a broader high-yield market default cycle”…

Based on recent stress tests of subprime borrowers in the energy sector in the US produced by Deutsche Bank, should the price of US crude fall by a further 20pc to $60 per barrel, it could result in up to a 30pc default rate among B and CCC rated high-yield US borrowers in the industry. West Texas Intermediate crude is currently trading at multi-year lows of around $75 per barrel, down from $107 per barrel in June.

“A shock of that magnitude could be sufficient to trigger a broader high-yield market default cycle, if materialized,” warn Deutsche strategists Oleg Melentyev and Daniel Sorid in their report.

If the price of oil stays at this level or continues to go down, it is inevitable that we will start to see some of these junk bonds go bad.

In fact, one Motley Fool article recently stated that one industry analyst believes that up to 40 percent of all energy junk bonds could eventually go into default…

The junk bonds, or noninvestment-rated bonds, of energy companies are also beginning to see heavy selling as investors start to worry that drillers could one day default on these bonds. Those defaults could get so bad, according to one analyst, that up to 40% of all energy junk bonds go into default over the next few years if oil prices don’t recover.

That would be a total nightmare for Wall Street.

And of course bond defaults would only be part of the equation. As I wrote about the other day, a crash in junk bonds is almost always followed by a significant stock market correction.

In addition, plunging oil prices could end up absolutely destroying the banks that are holding enormous amounts of energy derivatives. This is something that I recently covered in this article and this article.

As you read this, there are five “too big to fail” banks that each have more than 40 trillion dollars in exposure to derivatives. Of course only a small fraction of that total exposure is made up of energy derivatives, but a small fraction of 40 trillion dollars is still a massive amount of money.

These derivatives trades are largely unregulated, and even Forbes admits that they are likely to be at the heart of the coming financial collapse…

No one understands the derivative risk positions of the Too Big To Fail Banks, JP Morgan Chase, Citigroup, Bank of America, Goldman Sachs or Morgan Stanley. There is presently no way to measure the risks involved in the leverage, quantity of collateral, or stability of counter-parties for these major institutions. To me personally they are big black holes capable of potential wrack and ruin. Without access to confidential internal data about these risky derivative positions the regulators cannot react in a timely and measured fashion to block the threat to financial stability, according to a National Bureau of Economic Research study.

So do we have any hope?

Yes, if oil prices start going back up, much of what you just read about can be averted.

Unfortunately, that does not seem likely any time soon. Even though U.S. energy companies are cutting back on capital expenditures, most of them are still actually projecting an increase in production for 2015. Here is one example from Bloomberg…

Continental, the biggest holder of drilling rights in the Bakken, last month said 2015 output will grow between 23 percent and 29 percent even after shelving plans to allocate more money to exploration.

Higher levels of production will just drive the price of oil even lower.

At this point, Morgan Stanley is saying that the price of oil could plummet as low as $43 a barrel next year.

If that happens, it would be absolutely catastrophic to the most important industry in the United States.

In turn, that would be absolutely catastrophic for the economy as a whole.

So don’t let anyone tell you that much lower oil prices are “good” for the economy.

That is just a bunch of nonsense.

While the events down in Ferguson play out, back in Chicagoland, HeyJackass reports that the same old bullshit continues day in and day out with nary a peep. In the 107 days since officer Darren Wilson shot and killed 18 year old Michael Brown – 12:03pm, Saturday, August 9th – the following stupidity has taken place in Chicago:

Brutal, yet incredibly asinine and absurd to say the least.

So what is it about these stats that hasn’t caused people to lose their collective shit?

After all, there have been plenty of opportunities to march, chant, throw shit, break stuff, come up with a hashtag, etc… in the past few months, not only in Chicago, but all over the nation. So where is the national media? The cable news talking heads? The race pimpin’ super duo of Jesse and Al? The professional agitators and social justice warriors? The exploiting politicians? Almost 900 shootings and homicides in the past three months and not one is worthy of their attention.

Someone from ‘round these parts once said “never let a crisis go to waste”. Apparently these stats aren’t crisis-y enough.

* * *

Click here for full Chicago breakdown

Presented with no comment aside from a small adolescent smirk...

Russian Fighter Jet or giant cock'n'balls?

h/t @Marc_Leibowitz

Remember when last December, a bout of cold weather crushed the US economy for the next 3 months, and subtracted about $100 billion from trendline growth, and when one after another economist (who were then predicting the yield on the 10 Year would "greatly rotate" to 4% by right about now, and who expected the US economy to have reached escape velocity in the second half only to see a 2014 GDP trendline as follows Q2: 4.6%, Q3: 3.5% (soon to be reviser lower), and Q4 now estimated just about 2.0%) blamed the then -3.0% GDP print on snow in the winter? Well here comes round two, because as CBS reports, "prepare for an invasion from the north. A blast of polar air is about to send temperatures plunging in the heart of America."

The polar vortex is back, and this time it means even less business: A mass of whirling cold air will dip southward this weekend, sending the mercury plunging. As the cold air moves south and east, it has the potential to affect as many as 243 million people with wind chills in the single digits in some places and snow.

Of course, the implication is that Q4 GDP is about to have its lights out moment. Either that, or if Q4 GDP mysteriously does not collapse, then scapegoating the weather for what was a fundamental flaw with the economy (and subsequent definitional revisions to GDP were the primary source of "economic growth" in 2014), will be just that.

According to CBS, the cause of the latest and greatest bout of abnormally cold winter weather is not "global warming" but a Supertyphoon named Nuri, currently located above the North Pacific.

Suomi NPP VIIRS Infrared image of the eye of Super Typhoon Nuri in the West Pacific Ocean on November 2, 2014

However, as CBS explains, "it would be wrong to think that it will affect only Alaska's far-flung Aleutian Islands or those famous fishermen who work in the North Pacific."

Images from the European Space Station show that Nuri is a growing meteorological bomb blanketing the Bering Sea. The 50-foot waves and 100 mile-an-hour winds will make conditions similar to those we had two years ago, and could make Nuri the biggest storm of the year.

"The remnants of Super Typhoon Nuri will create a big buckle in the jet stream," WBBM's meteorologist Megan Glaros in Chicago explains. "And in several days time, it's going to mean a big dip in the jet which will connect us with a big mass of Arctic air -- taking temperatures east of the Rockies down to 10 to 30 degrees below average."

So how does a typhoon over the North Pacific lead to what may be a several percentage points drop in US GDP? The following sequence of events from EarthSky explains:

On November 2, forecasters thought Super Typhoon Nuri might strengthen further into a 195 mph storm with gusts near 235 mph. Fortunately, it peaked at 180 and started to gradually weaken on Monday. Nuri becomes the sixth Super Typhoon of the Western Pacific season, largely due to the unusually warm waters and favorable atmospheric conditions across the Western Pacific basin.

The storm will gradually weaken over the next couple of days into a tropical storm. It will stay east of Japan and move out into the Northern Pacific Ocean.

GFS model showing Typhoon Nuri on November 6, 2014. Image Credit: Weatherbell

As it gains latitude, the storm will transition from a warm-core low to a cold-core low, also known as an extratropical cyclone.The Northern Pacific jet stream will enhance the storm’s intensity. It will begin to “bomb out”, meaning the barometric pressure will drop drastically. Bombogenesis is a meteorological term used to define mid-latitude cyclones that drops at least 24 millibars within 24 hours.

Typhoon Nuri becomes extratropical as it gains energy from the Northern Pacific jet stream. Image Credit: GFS via Weatherbell

It’ll become a super strong storm with a pressure around 915 to 922 millibars. Imagine a “Superstorm Sandy” over the North Pacific instead of the east coast of the United States. The storm will affect the Bering Strait, and extreme winds and surf is expected.

A mega storm forms near the Bering Strait Friday evening into Saturday morning via GFS model. Image Credit: Weatherbell

The storm will affect parts of the Alaska coast by Friday into Saturday. Some areas will likely experience hurricane force winds, high seas of 30 feet or greater, and minor coastal flooding/erosion in parts of southwest Alaska coastal areas. Some of our weather models are even projecting waves as high as 50 feet!

Further color comes from Andrew Freedman of Mashable:

To put that into perspective, consider if the storm’s minimum central pressure bottoms out below 925 millibars — as is currently forecast by most computer models — it would set a record for the lowest pressure recorded in the Bering Sea. The current record holder is 925 millibars, set in October 1977 in Dutch Harbor, Alaska

Back to EearthSky:

The storm will influence the jet stream and atmospheric patterns across the Northern Hemisphere. It will likely trigger a ridge of high pressure across the Eastern Pacific and into Western North America. Meanwhile, it’ll likely contribute to a large trough that will dig down into parts of Central/Eastern Canada and the United States. As the jet stream digs south, it will likely bring the year’s first round of arctic air into the regions. Some of the weather models are indicating the potential for single digits in the Northern Plains by late next week (November 13-15). It is still uncertain if it will produce a big storm for the eastern United States. However, both the GFS and ECMWF models indicate a significant surge of cold air into the area.

The Climate Prediction Center is in agreement with a significantly colder weather pattern setting up for next week. They are forecasting temperatures well below average for Central and Eastern United States with above average temperatures likely along the west coast of Canada and the United States.

To summarize: Nuri will likely cause hurricane-like conditions along the Bering Strait as it becomes extratropical (no longer a tropical cyclone). It will help amplify the jet stream and likely produce a surge of very cold air that will reach parts of central/eastern Canada and the United States by November 12-15, 2014. There remains uncertainty regarding how cold the pattern will be, but as soon as models get within three to five days of the forecast, we will truly get a better idea of the overall setup and if a storm will develop.

Now, the only question is how the resultant tumble in Q4 GDP will be used by the Fed and econo-pundit talking heads to justify a further delay in rate hikes, which consensus expects to take place in Q2 2015 at the latest as a result of recent seasonally massaged "strong data", or better yet, force the Fed to resume liquidity injections once it is revealed that the ECB's intervention is limited to verbal jawboning, while Japan's runaway import cost inflation and plunging real wages lead to a revulsion against Abenomics and Abe in 2015, and a premature end to Japan's epic hyper-reflation experiment and the best laid plans of Goldman Sachs to boost "risk assets" and Goldman year end bonuses.